What is the mortgage underwriting process?

Mortgage underwriting holds the key to your successful application. We explain what happens during the process and how you can help it go more smoothly.

Mortgage underwriting is where your lender assumes financial risk in exchange for the interest you pay. Because they need to ensure this risk is acceptable, underwriting a mortgage is a meticulous process.

What is the role of a mortgage underwriter?

A mortgage underwriter is employed by the mortgage lender to scrutinise your mortgage approval and make a recommendation of a final decision on whether the lender should loan you the money you need.

The underwriter's primary focus is evaluating the risk associated with your application. They assess the likelihood of you defaulting on the loan, verify the validity of submitted documents, and ensure compliance with the lender's and regulatory requirements.

During this process they will assess your:

Affordability

Debts

credit history

property details

Once the mortgage underwriter greenlights your application, you're on a promising path to receiving a mortgage offer. But, if your circumstances change between the offer and completion, the lender can still decline your application.

What happens before the underwriting process?

Soft credit search and scorecarding is usually carried out by a mortgage broker during a fact-finding session. This is to make a decision on your mortgage agreement in principle (MIP)

Once you have the MIP, you can go ahead and make an offer on your chosen property

The lender will assess your property's value to ensure it’s worth what you’re offering

This is where the underwriting process usually takes place, which hopefully leads to your full mortgage offer

How long does mortgage underwriting take?

Typically, you can expect a mortgage underwriting decision within a week. However, the duration may vary, particularly during peak application periods. Promptly providing any requested additional information can speed up the process.

Our job at Mojo is to make sure we’ve pre-empted any potential delays and done all we can to ensure you avoid them.

What happens if my application is rejected?

Underwriters leave no stone unturned, and applications declined at this stage generally fall into two categories:

Changed Circumstances: If your financial situation has changed, for example, you’ve suffered a job loss or taken on new loans

High Risk Flagging: Underwriters may detect discrepancies in your finances, non-disclosure of financial commitments, or even inappropriate language in payment references, classifying your application as high risk

At Mojo, we know lender rules and underwriting processes well, so our mortgage advisors can work with you to recommend alternative lenders before you make your application, if we feel there is a chance you wouldn’t be approved.

However, our ability to do so is dependent on your honesty and openness from the beginning of your journey. It’s better to deal with potential blockers early, so we can make sure you approach the right lender, or even come back and apply at a time when you’re more likely to be successful.

Will I know why I’ve been rejected?

Lenders typically provide this information, but, at Mojo, we can assist in obtaining it if they don’t.

If your application is declined, it may be advisable to wait a few months before reapplying, even with a different lender.

Ready to be clear about your mortgage options?

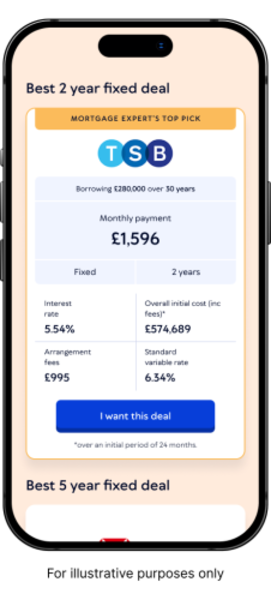

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.